Remember last week when I applied for (and got) a Victoria’s Secret credit card? Well, it came in the mail on Tuesday. (And I paid off the balance, in case you’re wondering. Oh, and the bra worked out, too.)

When I called to activate the card, I had to listen to this long spiel about some kind of protection program that will pay off my balance if I get attacked by wolverines or get fired for blogging on the job. And it only costs $1.99 for every $100 charged to the card! I’m like, “No, I’m not interested,” which means the poor girl had to read the whole script AGAIN since I obviously didn’t understand what I was turning down. The second time I’m like, “I’m not going to carry a balance anyway,” which was a mistake because then she got all excited and told me I wouldn’t have to pay the $1.99 if I didn’t have a balance. And started reading the script a third time.

Finally, I interrupted her and said, “Look, if I have to go through all this to activate the card, I changed my mind. I don’t want to activate it.” Apparently that’s the magic phrase because she shut up and told me my card is now active. I logged into my account, paid off my balance, and now the card is put away in the place where unused credit cards go to gather dust.

For kicks, I decided to look at all the crap that came with the card. And I’m both disgusted and impressed by the marketing techniques VS (I first typed BS, ha!) uses to make sure you use your Angel card.

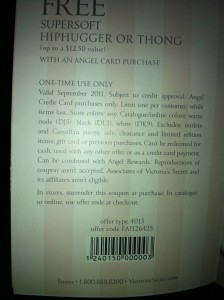

1. Monthly coupons for cardholders only.

For the month of September, I can get a FREE hiphugger or thong panty. All I have to do is use my VS card to buy something else! However, if I use the coupon online, I’m limited to the gross boring colors - white, beige, or black. Because they want me in the store, where I’ll see the cute colors and want them instead, plus the matching accessories and OMG this perfume smells awesome! Yeah, I see what they’re doing there. And there’s a coupon for every month, all of which offer a similar “deal.”

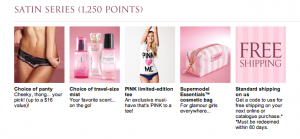

2. Rewards.

I get 12 reward points for every dollar I charge on my card! And if I save up 1250 of them (meaning I’ve charged about $105), I can get a FREE gift from the satin series in the reward store! What does THAT get me?

Random stuff that I don’t really need. Like a teeny little sample size perfume. And a “cosmetic bag” that probably holds the sample size perfume. Sure, I’ll take it if I ever earn it (I have 935 points right now per the website) but do people really buy stuff just to earn a dinky little something for free? You bet they do! Oh, P.S. You have to redeem your reward points within 60 days or you lose them. OMG I better buy a bunch of stuff before I lose my points!!! (kidding)

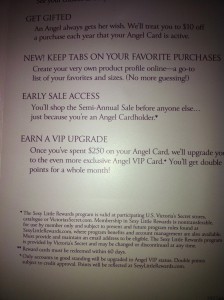

3. The “VIP Upgrade”

After I charge $250 on my VS card, I’ll be magically upgraded to the Angel VIP card. It’s sleek and black instead of girly pink, it’s “even more exclusive” (whatever that means) and I get DOUBLE POINTS FOR A WHOLE MONTH!

4. The Less Emphasized Details

Shoved in the envelope behind all the pretty glam market crap was a yucky white paper with all the details about the VS card. Which I’m sure most people throw away.

24.99% APR for purchases. Ho. Lee. Crap.

$35 late payment fee. Gee, would you like my firstborn child as well? A limb, maybe? I’ll just pay on time, thanks.

So what does all this teach us, kids?

In my former life, I would have been SO flattered to receive such an amazing offer. And I know how dumb that sounds, but I totally bought into messages like “Let the indulgence begin” (inside the pamphlet) and words like free and exclusive. As I said when I applied for the card, I’m not a huge underwear shopper, but I probably would have become one if this had happened a few years ago.

These days, I don’t need a bunch of underwear or card-related perks to make me feel special. I’m pretty darn cool on my own. Sometimes anyway.

When we attach our self-worth to the stuff we own, debt is second nature.

You can be a fun, amazing person without spending a dime. The sooner you figure that out, the sooner you can get over your debt and move on. If you need to belong to an “exclusive” club, I’ll make you a So Over Debt VIP card. Every time you DON’T buy anything, you get the satisfaction of knowing you didn’t buy into the hype.