You know what I mean. The moment when you realized, Holy crap! I need to do something about my money situation! Not just thinking about doing something, but actually deciding to do it.

For me, it's kind of hard to pinpoint. I already told you about my passionate love affair with PNC Virtual Wallet. I opened the account in December, and changes crept up on me before I knew what was happening. Being able to see my money visually made me want to hang on to more of it. I got some money for Christmas and deposited it right before walking into a mall - I fully intended to shop. As we walked through the mall, though, I didn't see anything I could justify. I tried on some shoes (my weakness!) but didn't want to pay $65 for them.

When I got home from the mall, I moved the Christmas money into savings and felt the strangest feeling. It was a mixture of pride, excitement, and maybe...fear? Historically, any time I put money in my savings account, I ended up pulling it out within a few days to buy something or keep a check from bouncing. I was scared to change because I didn't know if I had the willpower to maintain it. But this time I thought about the Christmas money a little differently - I realized that if I hadn't gotten it, I wouldn't have starved to death or lost my home. It was truly extra money. And every time I added to it, saving became easier.

I didn't know it then, but that first small deposit was my lightbulb moment. Maybe a "gateway drug." Because right after that, I looked for ways to save more. I started cutting costs and spending less. I used my tax return to pay off credit cards instead of buying the bedroom furniture I desperately need but can live without for awhile longer. Then I changed my W4 to eliminate a tax return so I'd have more money to save. I joined Twitter so I could keep up with posts from finance blogs. I even started my own blog to hold myself accountable! My entire mindset shifted because of one small step.

So, my two or three readers out there, what was YOUR lightbulb moment? I'd love to hear your stories!

Friday, February 25, 2011

What was your lightbulb moment?

Posted by

Andrea

at

10:00 PM

1 comments

Email This

BlogThis!

Share to Twitter

Share to Facebook

Share to Google Buzz

Labels:

debt

Tuesday, February 22, 2011

PNC Virtual Wallet: Love of My Life

PNC's Virtual Wallet is one of the biggest contributors to my financial turnaround. I don't work for PNC, and they don't pay me to tell people about Virtual Wallet (though they should!), but I talk about it all the time. Gushing to follow.

When I decided I needed to get my money straightened out, I knew I needed a new bank. Since 2002, I used a tiny local bank that didn't meet my needs and, frankly, pissed me off. Between my mistakes (overdraft fees, anyone?) and theirs (taking $500 out of my account instead of someone else's, then waiting 3 months to reimburse me), I found myself frustrated every time I logged onto their useless website. Transactions wouldn't show up for days, so I never really knew how much money I had available. (Confession: I don't keep a checkbook ledger. My fault? Yes. But still.) I researched checking accounts for a long time and PNC was the clear winner for me, simply because of the miracle they call Virtual Wallet.

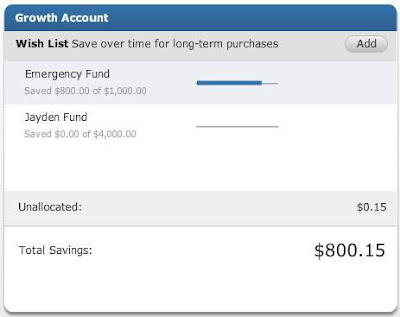

What is it? Virtual Wallet is a set of three linked accounts developed for Generation Y. The first account, Spend, is an everyday checking account. This is the one I use for paying bills, buying groceries, etc. It comes with a Visa Check Card and free starter checks. The second account, Reserve, is an interest-bearing checking account used for short-term savings. For example, if I'm saving for an Apple TV (my most recent purchase), I can make a category on my Wish List called Apple TV and set my goal at $100. The third account, Growth, is an interest-bearing checking account used for longer term savings. I can set up categories under Growth as well. Right now I have one called Emergency Fund and another for my son's savings. Both the Reserve and Growth accounts serve as overdraft protection for the Spend account.

So what's the big deal? The big deal with Virtual Wallet is the user interface. This is NOT your average boring bank site. I have never had more control over where my money goes or how much I save. There are a ton of features in Virtual Wallet that simply aren't offered anywhere else. I'll show you what I mean.

Calendar View: When I log in to my account, I see a monthly calendar with all my scheduled payments and transactions. This allows me to see the overall picture of what's coming out, when I get paid again, and what I've spent this month. If I'm in danger of overdrawing on a particular day, that day will be red on the calendar, giving me a chance to deposit money or move a payment around to avoid the fee.

You'll notice there is an uncashed check on the list - that's one of the beautiful things about Virtual Wallet. When I write a check (a very rare thing for me), I can enter it online and it will remove that amount from my free balance until the check clears. No more forgetting I wrote a check and getting hit with an overdraft fee. I can also schedule my bills through the calendar, and PNC pays them for me when they're due. They even mail a check for my water bill since I can't pay it electronically.

Free vs. Available Balance: One of the biggest problems with failing to keep a checkbook ledger was never knowing for sure how much money I could spend. I would keep a running total in my head, but I always managed to forget some automatic payment, a check, or a debit that took awhile to post. Virtual Wallet's Money Bar keeps me in check no matter how much I've forgotten by differentiating between my available balance (what's in there right this minute) and my free balance (what I can spend without messing up the stuff scheduled out).

As you can see, I'm kind of broke at the moment. :) But notice the difference between the $93.80 I have available and the $87.38 that is actually free. If my bank only showed me the available balance, I might think I can spend $90 without overdrawing. Since I have $6.42 scheduled out, though, spending $90 would overdraw my account and result in a hefty fee. Also, the Money Bar shows me what's in my Reserve account in case I'm running low. I can drag the arrows to move money between the two accounts.

Reserve Detail: If I want to see what's going on with my Reserve account, I can see my savings categories with nifty progress bars to remind me how close I am to my goals.

The tab for Reserve Items includes any expense you already have the money for but want to keep out of your free balance. For example, I saved back some Christmas money to pay taxes on my car. I made a category under Reserve Items called Car Taxes, put the money in it, and set a reminder on the Calendar to move it back when it was time to pay. Super easy! I can also view the Wish List in my Growth account:

Punch the Pig: One of the coolest feature of Virtual Wallet is the ability to Punch the Pig. Randomly (or all the time, if you choose), a cute pig icon will pop up on the screen. If you click it, you can transfer as little as $1 to your Growth account. When I was spending money like crazy, I used to justify things by saying, "It's only a dollar. It's only ten dollars." Well, now I do the same thing with saving money! I see the pig and can't help clicking. It even makes an oinking sound when you click.

Other Features: Lest I create the longest blog post in the history of the world, I'll summarize the other important features of Virtual Wallet.

- There is an awesome budget feature right on the site that allows me to track my spending. If I get close to the limit I set, I get a text message telling me I'm overspending.

- There is a Virtual Wallet iPhone app so I can see my Money Bar even when I'm not near a computer. (Android app is expected this year.)

- I get a text anytime my debit card is used online, so I know if someone is using my card without my knowledge.

- No fees, no minimum balance, $25 to open. Let me repeat: NO FEES. This is becoming a rarity.

If you're in the market for a checking account, I would highly recommend PNC Virtual Wallet. I can't say enough good things about my experience. If you arrived here through a search and have questions about Virtual Wallet, feel free to email me.

Posted by

Andrea

at

9:31 PM

3

comments

Email This

BlogThis!

Share to Twitter

Share to Facebook

Share to Google Buzz

Labels:

banking,

PNC Virtual Wallet,

review

Sunday, February 20, 2011

My Financial Beginnings, Part Two

If you missed Part One, you might want to start there to get the full picture of where I'm coming from.

After a short detour, I'm back to finish the story of how I got into so much debt. When I left off, I was newly married with a toddler and spending like crazy. I wish I could say the turning point came soon after, but I was far from finished with my financial disaster.

Starting in 2004, a few huge events happened in short succession. First, my landlord called on Memorial Day to tell me he was selling our rental house out from under us. We had lived there 2 1/2 years, always paying the rent on time, and I was a blubbering mess by the time I got off the phone. We had two dogs - how would we find a place to rent in our tiny rural town without getting rid of them? I took advantage of my summer off from classes and spent every day calling realtors and classified ads. After several weeks (and a few more phone calls from the landlord asking if we were ready to move out yet), it became apparent we weren't going to find a place. We decided to find out if we could buy a home. Oh yes, with all our debt and irresponsible spending, we thought homeownership was a smart choice.

I called a mortgage company that was more than happy to prequalify us for a loan. They were only interested in our credit history for the 36 months prior, and they conveniently left all the debt out of the equation because it was in my name and I wasn't working. Thank goodness I was smart enough to realize we were approved for more than we could afford, so we figured out a limit for ourselves and found a house. By August 2004, we owned a home. Our families (even my dad, who is my most trusted financial advisor) thought this was a great idea. I decided to take out a private student loan to consolidate our $10,000 in credit card debt, which my dad reluctantly cosigned for, to offset the increase in housing costs. I even made a half-assed attempt at a budget, and for the first few months we were doing well.

In February 2005, my grandmother died unexpectedly on my 22nd birthday. I was months away from finishing my bachelor's degree. I watched helplessly as my entire family fell apart, each of us turning to our own (mostly unhealthy) coping skills to make sense of what had happened. Which for me meant ramping up the shopping. In my eyes, my grandmother was a true lady, an example of what I should be someday, and I decided this was a good time to pay tribute to her. Her house was always impeccably decorated, her jewelry and clothing perfectly coordinated.... I was going to be just like that. Unfortunately I was missing the part where my husband was a retired coal miner who made excellent financial decisions and could afford that kind of lifestyle.

Two weeks after I graduated, I started classes for my master's degree. I spent every dime of my graduation money on new shoes, purses, and clothes for grad school. I bought a new laptop even though there was nothing wrong with my old one. When I needed to record a mock therapy session for a class, I bought a $400 camcorder instead of borrowing one. All the credit cards I had paid off were once again maxed out, and I increased my federal student loan borrowing each semester to pay them down.

In 2006, I graduated with a Master of Social Work and a 4.0 GPA, still one of the proudest moments of my life. As a teenage mother, I wasn't supposed to make it that far. I had something to prove and I felt I had succeeded. Too bad the job market didn't agree with me. While there were quite a few jobs available in 2006 (especially compared to right now!), I lacked the experience to get them. My undergrad and grad school internships didn't count as work experience, which was something I had relied on.

Also in 2006, new banking guidelines raised the required minimum payments on credit cards. Our monthly minimums went from about $225 to over $500. Quickly, it became apparent that we couldn't afford to pay our bills. For the first time, I had to choose which payments to make and which to skip. After several months of ignoring the ringing phone and asking my parents for money to buy groceries, we decided to file Chapter 7. I could write a whole post about the bankruptcy, and I might sometime, but I'll just summarize by saying it was humiliating yet necessary. We were able to keep our home and my husband's car, but all the unsecured debt went away. It was nice to be able to answer the phone again. Unfortunately, that stupid private student loan did NOT go away, though they did raise my interest rate to 15% once the bankruptcy hit my credit report.

A week after our court date, I got a job offer 50 miles from home. I had to buy a car, and of course I paid through the nose because of the bankruptcy. 18% interest on a used car should be against the law! But it's not, and it wasn't, so I paid. Our income more than doubled and we rewarded ourselves by eating out, buying more stuff, and reasoning that at least we weren't using credit cards. We didn't save a dime. It makes me sick to look back at all that waste and how much I could have saved in the beginning. Since it was new income, we never would have missed it. Yet I was too busy spending. I also got a few more credit cards to "rebuild my credit," which are the cards you see me paying off right now. Five years later and I am still paying for stupid mistakes.

I won't go into the details of the demise of my marriage, but I'll say it started around the same time as the bankruptcy. There were a lot of problems, a lot of resentments and finger-pointing, and way too much stress. I made a few feeble attempts to control our spending, but my husband thwarted me every time. He pointed out constantly that all the pre-bankruptcy debts were in MY name, not his, and that I benefited most from the spending. I have to admit, the latter part is true. Just when I started rethinking things and trying to spend less, he decided it was his turn to spend more. Money was far from the biggest problem we had, but it sure didn't make the other stuff any easier to deal with.

In 2009, I made the decision to divorce. Because I made more money, I felt guilty about leaving my ex with more than he could handle. I let him keep the house and almost everything in it, other than the dining room table I'd purchased with my very first paycheck. I took only my personal things and my son's when I moved into my current home. I also took most of the debt. I made the very personal choice not to ask for child support, provided he keeps our son on his health insurance, because I knew I would spend way too much energy trying to collect money he wouldn't have. Or loaning him money when his child support payments prevented him from paying his electric bill. A lot of people have expressed disagreement with this, but I try to be realistic. I don't want to depend on something I know I'll never get. I want to do this on my own.

So that brings us pretty much to my present-day financial struggles, which I'll begin explaining in more detail now that the long backstory is out of the way. I promise I'm not always this long-winded. Most of the time, yes, but I'll make an effort from now on. :)

After a short detour, I'm back to finish the story of how I got into so much debt. When I left off, I was newly married with a toddler and spending like crazy. I wish I could say the turning point came soon after, but I was far from finished with my financial disaster.

Starting in 2004, a few huge events happened in short succession. First, my landlord called on Memorial Day to tell me he was selling our rental house out from under us. We had lived there 2 1/2 years, always paying the rent on time, and I was a blubbering mess by the time I got off the phone. We had two dogs - how would we find a place to rent in our tiny rural town without getting rid of them? I took advantage of my summer off from classes and spent every day calling realtors and classified ads. After several weeks (and a few more phone calls from the landlord asking if we were ready to move out yet), it became apparent we weren't going to find a place. We decided to find out if we could buy a home. Oh yes, with all our debt and irresponsible spending, we thought homeownership was a smart choice.

I called a mortgage company that was more than happy to prequalify us for a loan. They were only interested in our credit history for the 36 months prior, and they conveniently left all the debt out of the equation because it was in my name and I wasn't working. Thank goodness I was smart enough to realize we were approved for more than we could afford, so we figured out a limit for ourselves and found a house. By August 2004, we owned a home. Our families (even my dad, who is my most trusted financial advisor) thought this was a great idea. I decided to take out a private student loan to consolidate our $10,000 in credit card debt, which my dad reluctantly cosigned for, to offset the increase in housing costs. I even made a half-assed attempt at a budget, and for the first few months we were doing well.

In February 2005, my grandmother died unexpectedly on my 22nd birthday. I was months away from finishing my bachelor's degree. I watched helplessly as my entire family fell apart, each of us turning to our own (mostly unhealthy) coping skills to make sense of what had happened. Which for me meant ramping up the shopping. In my eyes, my grandmother was a true lady, an example of what I should be someday, and I decided this was a good time to pay tribute to her. Her house was always impeccably decorated, her jewelry and clothing perfectly coordinated.... I was going to be just like that. Unfortunately I was missing the part where my husband was a retired coal miner who made excellent financial decisions and could afford that kind of lifestyle.

Two weeks after I graduated, I started classes for my master's degree. I spent every dime of my graduation money on new shoes, purses, and clothes for grad school. I bought a new laptop even though there was nothing wrong with my old one. When I needed to record a mock therapy session for a class, I bought a $400 camcorder instead of borrowing one. All the credit cards I had paid off were once again maxed out, and I increased my federal student loan borrowing each semester to pay them down.

In 2006, I graduated with a Master of Social Work and a 4.0 GPA, still one of the proudest moments of my life. As a teenage mother, I wasn't supposed to make it that far. I had something to prove and I felt I had succeeded. Too bad the job market didn't agree with me. While there were quite a few jobs available in 2006 (especially compared to right now!), I lacked the experience to get them. My undergrad and grad school internships didn't count as work experience, which was something I had relied on.

Also in 2006, new banking guidelines raised the required minimum payments on credit cards. Our monthly minimums went from about $225 to over $500. Quickly, it became apparent that we couldn't afford to pay our bills. For the first time, I had to choose which payments to make and which to skip. After several months of ignoring the ringing phone and asking my parents for money to buy groceries, we decided to file Chapter 7. I could write a whole post about the bankruptcy, and I might sometime, but I'll just summarize by saying it was humiliating yet necessary. We were able to keep our home and my husband's car, but all the unsecured debt went away. It was nice to be able to answer the phone again. Unfortunately, that stupid private student loan did NOT go away, though they did raise my interest rate to 15% once the bankruptcy hit my credit report.

A week after our court date, I got a job offer 50 miles from home. I had to buy a car, and of course I paid through the nose because of the bankruptcy. 18% interest on a used car should be against the law! But it's not, and it wasn't, so I paid. Our income more than doubled and we rewarded ourselves by eating out, buying more stuff, and reasoning that at least we weren't using credit cards. We didn't save a dime. It makes me sick to look back at all that waste and how much I could have saved in the beginning. Since it was new income, we never would have missed it. Yet I was too busy spending. I also got a few more credit cards to "rebuild my credit," which are the cards you see me paying off right now. Five years later and I am still paying for stupid mistakes.

I won't go into the details of the demise of my marriage, but I'll say it started around the same time as the bankruptcy. There were a lot of problems, a lot of resentments and finger-pointing, and way too much stress. I made a few feeble attempts to control our spending, but my husband thwarted me every time. He pointed out constantly that all the pre-bankruptcy debts were in MY name, not his, and that I benefited most from the spending. I have to admit, the latter part is true. Just when I started rethinking things and trying to spend less, he decided it was his turn to spend more. Money was far from the biggest problem we had, but it sure didn't make the other stuff any easier to deal with.

In 2009, I made the decision to divorce. Because I made more money, I felt guilty about leaving my ex with more than he could handle. I let him keep the house and almost everything in it, other than the dining room table I'd purchased with my very first paycheck. I took only my personal things and my son's when I moved into my current home. I also took most of the debt. I made the very personal choice not to ask for child support, provided he keeps our son on his health insurance, because I knew I would spend way too much energy trying to collect money he wouldn't have. Or loaning him money when his child support payments prevented him from paying his electric bill. A lot of people have expressed disagreement with this, but I try to be realistic. I don't want to depend on something I know I'll never get. I want to do this on my own.

So that brings us pretty much to my present-day financial struggles, which I'll begin explaining in more detail now that the long backstory is out of the way. I promise I'm not always this long-winded. Most of the time, yes, but I'll make an effort from now on. :)

Posted by

Andrea

at

4:08 PM

2

comments

Email This

BlogThis!

Share to Twitter

Share to Facebook

Share to Google Buzz

Saturday, February 19, 2011

How Things Changed

I've shared some of my financial background, so I thought this would be a good time to talk about how and why I decided to go from rabid spending to writing a blog about getting out of debt.

My divorce should have been the catalyst for a change in my thinking, but it wasn't. My parents bought a house, which my dad and I spent months remodeling ourselves, for my son and me to move into. I did spend the first few months with no living room furniture (I waited for my tax return), but beyond that I spent just like I always had. I convinced myself that I could afford to do what I wanted without my ex spending us into oblivion. What I failed to do was acknowledge my own contribution to the financial problems in the marriage.

In my first year post-divorce, I can't count how many times I needed my parents' help to cover an overdraft fee or gas money until payday. In December 2010, exactly a year after the divorce was final, I realized I was about to turn 28 and still throwing money down the toilet, and I realized there wouldn't be a Prince Charming to come rescue me from my financial problems with his magic bank account. I also realized my ex will never better his situation (he lost his home to foreclosure after failing to make a single payment after I left) and it's up to me alone to make sure my son is taken care of.

So I opened a new bank account to escape my local bank's 1990s interface. I set up auto transfers to savings. I opened a Roth IRA because my employer doesn't offer a match on its 403(b). And I made a budget. In that moment, staring down the money I was throwing away every month, I decided I was never living like that again.

I have done a lot of small things to cut expenses in a big way. A promotion from Comcast lowered my cable/Internet bill from $110 to $45 for the next six months. I changed my AT&T; plan and cut $30 off my mobile bill. I increased my car insurance deductibles (now that I actually have money in savings in case of emergency) and saved $120 every six months. I have also started taking frozen dinners to work - $3 a meal is much better than $10+.

Most important, I've stopped justifying purchases. When I see $20 extra in the bank, I move it to savings instead of buying something. If I want something, I save for it. Beyond that, I only spend on bills, gas, and groceries. And it's amazing that I have nearly $800 in savings, the first time I've ever had savings in my life.

I still have a lot of progress to make, but I've made a conscious decision to stop the bleeding in my financial life. What things are you doing? What have I missed?

My divorce should have been the catalyst for a change in my thinking, but it wasn't. My parents bought a house, which my dad and I spent months remodeling ourselves, for my son and me to move into. I did spend the first few months with no living room furniture (I waited for my tax return), but beyond that I spent just like I always had. I convinced myself that I could afford to do what I wanted without my ex spending us into oblivion. What I failed to do was acknowledge my own contribution to the financial problems in the marriage.

In my first year post-divorce, I can't count how many times I needed my parents' help to cover an overdraft fee or gas money until payday. In December 2010, exactly a year after the divorce was final, I realized I was about to turn 28 and still throwing money down the toilet, and I realized there wouldn't be a Prince Charming to come rescue me from my financial problems with his magic bank account. I also realized my ex will never better his situation (he lost his home to foreclosure after failing to make a single payment after I left) and it's up to me alone to make sure my son is taken care of.

So I opened a new bank account to escape my local bank's 1990s interface. I set up auto transfers to savings. I opened a Roth IRA because my employer doesn't offer a match on its 403(b). And I made a budget. In that moment, staring down the money I was throwing away every month, I decided I was never living like that again.

I have done a lot of small things to cut expenses in a big way. A promotion from Comcast lowered my cable/Internet bill from $110 to $45 for the next six months. I changed my AT&T; plan and cut $30 off my mobile bill. I increased my car insurance deductibles (now that I actually have money in savings in case of emergency) and saved $120 every six months. I have also started taking frozen dinners to work - $3 a meal is much better than $10+.

Most important, I've stopped justifying purchases. When I see $20 extra in the bank, I move it to savings instead of buying something. If I want something, I save for it. Beyond that, I only spend on bills, gas, and groceries. And it's amazing that I have nearly $800 in savings, the first time I've ever had savings in my life.

I still have a lot of progress to make, but I've made a conscious decision to stop the bleeding in my financial life. What things are you doing? What have I missed?

Posted by

Andrea

at

11:27 AM

1 comments

Email This

BlogThis!

Share to Twitter

Share to Facebook

Share to Google Buzz

Tuesday, February 15, 2011

My Financial Beginnings

My parents definitely weren't big spenders. My dad worked a blue collar job and my mom stayed home with us. They were expert savers, though I didn't realize it when I was young. My sister and I had the same clothes and toys as our friends, and we paid full price for school meals even though I later learned we could have qualified for free lunch. I had no clue how much (or little) my dad made or how much effort my parents made to shield us from poverty.

Despite their good intentions, my parents made a mistake in hiding their financial difficulties. All I knew was I had the same LA Gear hightops and Lisa Frank Trapper Keepers as my friends at school - I didn't notice the fact that my mom wore hand-me-downs from neighbors, or that we rode to school in my dad's work van to save the gas in our family vehicle. Instead of learning the value of saving and spending carefully to have nice things, I learned that appearances were more important than reality. I became obsessed with accumulating things instead of realizing how much they actually cost. I love my parents and they are my biggest supporters, but they missed numerous opportunities to teach me the value of money and how to use it wisely.

I was just shy of 15 when I started dating the guy who would become my husband (and now ex-husband), S. He had a job delivering pizzas and couldn't really afford "real" dates, but I didn't mind. About four months into the relationship I found out I was pregnant. He asked me if I wanted to get married, but even in my irresponsible teenage head I knew it didn't make sense to get married when I couldn't even drive a car. We continued dating after our son was born, and he flew through job after job. My parents were disgusted, but at least he did buy diapers and formula (though I admit my parents contributed a lot). I was determined to finish school and go to college, and luckily my mom was able to babysit during the day while I did that. Make no mistake, though - I raised my child. When I wasn't at school, I was taking care of him 24/7. It was hard and sometimes I thought I would never make it. Thank goodness I was ambitious, and I completed both a bachelor's and master's degree by the time I was 23.

In 2001, S got a state job and liked it enough to stay. He's still working there, in fact. We got married in 2002 when our son was 3 1/2 years old. I was taking full time college classes and he made about $20,000 that first year. Everyone warned us how difficult it would be and how frugal we would need to be, but I didn't listen. Like my parents taught me, however accidental, I was going to work around our low income instead of learning to work with it. We financed brand new furniture through a "personal loan" with 15% interest. I got a string of credit cards to buy clothes, TVs, decorations for the house, and other junk. I took out the maximum amount for student loans every semester to pay for dinners out and shopping trips. I was responsible in my own mind because I also paid off my credit cards each semester, only to charge them up again. In short, our finances were a hot mess and we didn't even realize it.

Want the rest of the story? Check out Part Two of my financial history.

Despite their good intentions, my parents made a mistake in hiding their financial difficulties. All I knew was I had the same LA Gear hightops and Lisa Frank Trapper Keepers as my friends at school - I didn't notice the fact that my mom wore hand-me-downs from neighbors, or that we rode to school in my dad's work van to save the gas in our family vehicle. Instead of learning the value of saving and spending carefully to have nice things, I learned that appearances were more important than reality. I became obsessed with accumulating things instead of realizing how much they actually cost. I love my parents and they are my biggest supporters, but they missed numerous opportunities to teach me the value of money and how to use it wisely.

I was just shy of 15 when I started dating the guy who would become my husband (and now ex-husband), S. He had a job delivering pizzas and couldn't really afford "real" dates, but I didn't mind. About four months into the relationship I found out I was pregnant. He asked me if I wanted to get married, but even in my irresponsible teenage head I knew it didn't make sense to get married when I couldn't even drive a car. We continued dating after our son was born, and he flew through job after job. My parents were disgusted, but at least he did buy diapers and formula (though I admit my parents contributed a lot). I was determined to finish school and go to college, and luckily my mom was able to babysit during the day while I did that. Make no mistake, though - I raised my child. When I wasn't at school, I was taking care of him 24/7. It was hard and sometimes I thought I would never make it. Thank goodness I was ambitious, and I completed both a bachelor's and master's degree by the time I was 23.

In 2001, S got a state job and liked it enough to stay. He's still working there, in fact. We got married in 2002 when our son was 3 1/2 years old. I was taking full time college classes and he made about $20,000 that first year. Everyone warned us how difficult it would be and how frugal we would need to be, but I didn't listen. Like my parents taught me, however accidental, I was going to work around our low income instead of learning to work with it. We financed brand new furniture through a "personal loan" with 15% interest. I got a string of credit cards to buy clothes, TVs, decorations for the house, and other junk. I took out the maximum amount for student loans every semester to pay for dinners out and shopping trips. I was responsible in my own mind because I also paid off my credit cards each semester, only to charge them up again. In short, our finances were a hot mess and we didn't even realize it.

Want the rest of the story? Check out Part Two of my financial history.

Posted by

Andrea

at

7:58 PM

2

comments

Email This

BlogThis!

Share to Twitter

Share to Facebook

Share to Google Buzz

Sunday, February 13, 2011

My Debt/Savings Strategy

I got my progress bars posted so I thought this would be a good time to introduce my strategy, or lack thereof.

I'm not patient enough to do things by the book. I want to see improvements in my situation fairly quickly, so I've taken a lot of advice and molded it to fit what I feel I need to do.

First, I have started saving even though I'm not out of debt. I have literally lived paycheck to paycheck for my entire adult life, and I'm tired of it. I don't like running to my parents or a credit card when I get a flat tire. So I've started auto transfers to my savings account, and while it will take forever to get to my goal of $5000, at least I know I'm getting there.

I also opened a Roth IRA because it occurred to me that I'm approaching 30 and have nothing saved toward retirement. The tiny $25 you see now was my initial deposit to open my Roth, and I'll be contributing $100 a paycheck in hopes of reaching $2000 by the end of the year. I changed my W4 at work to eliminate a tax return and gain the extra money to put into my Roth. I don't even notice it's gone! Of course I want to max it out eventually, but I know that won't happen as long as I'm carrying so much debt.

The debts I've listed are in order of attack. All of my credit card debt is high interest, so it didn't make a huge difference which one I worked on first. I chose to pay off Merrick Bank because (1) they closed my account when I stopped using it and (2) it had the highest minimum payment, which freed up more money for my snowball. I paid off Orchard because they are owned by HSBC. I hate HSBC with all my heart. Both of those credit cards were paid off with my tax refund.

I've now switched gears and I'm paying off my Target card. I need the psychological boost of paying something off quickly. I'm paying $105 a month toward Target so it will be gone soon. I'll then pay $130 a month to Dell and get rid of it by the end of the year. The car payment is next - I recently refinanced my horrible 12.7% loan to a slightly better 8.93% (not bad for 4 years out of Chapter 7!). I was able to shorten the length of the loan, and I'll continue paying my old payment amount even though the new one is $60 cheaper.

My system is a little complicated, but I'm happy with it for now. Every week, I'm making a payment or transferring to savings or contributing to my Roth. My finances are constantly active, and as a result, I'm active in keeping track of them.

I'm not patient enough to do things by the book. I want to see improvements in my situation fairly quickly, so I've taken a lot of advice and molded it to fit what I feel I need to do.

First, I have started saving even though I'm not out of debt. I have literally lived paycheck to paycheck for my entire adult life, and I'm tired of it. I don't like running to my parents or a credit card when I get a flat tire. So I've started auto transfers to my savings account, and while it will take forever to get to my goal of $5000, at least I know I'm getting there.

I also opened a Roth IRA because it occurred to me that I'm approaching 30 and have nothing saved toward retirement. The tiny $25 you see now was my initial deposit to open my Roth, and I'll be contributing $100 a paycheck in hopes of reaching $2000 by the end of the year. I changed my W4 at work to eliminate a tax return and gain the extra money to put into my Roth. I don't even notice it's gone! Of course I want to max it out eventually, but I know that won't happen as long as I'm carrying so much debt.

The debts I've listed are in order of attack. All of my credit card debt is high interest, so it didn't make a huge difference which one I worked on first. I chose to pay off Merrick Bank because (1) they closed my account when I stopped using it and (2) it had the highest minimum payment, which freed up more money for my snowball. I paid off Orchard because they are owned by HSBC. I hate HSBC with all my heart. Both of those credit cards were paid off with my tax refund.

I've now switched gears and I'm paying off my Target card. I need the psychological boost of paying something off quickly. I'm paying $105 a month toward Target so it will be gone soon. I'll then pay $130 a month to Dell and get rid of it by the end of the year. The car payment is next - I recently refinanced my horrible 12.7% loan to a slightly better 8.93% (not bad for 4 years out of Chapter 7!). I was able to shorten the length of the loan, and I'll continue paying my old payment amount even though the new one is $60 cheaper.

My system is a little complicated, but I'm happy with it for now. Every week, I'm making a payment or transferring to savings or contributing to my Roth. My finances are constantly active, and as a result, I'm active in keeping track of them.

Posted by

Andrea

at

8:53 PM

2

comments

Email This

BlogThis!

Share to Twitter

Share to Facebook

Share to Google Buzz

Labels:

debt

What am I getting myself into?

Honestly, I can't believe I'm blogging. I love to read blogs; never saw myself writing one. But there have been a lot of changes in my financial life lately and I need a place to keep track of things. I think my Facebook friends are getting a little tired of all my money-related posts, so I'll share with complete strangers instead!

A little background: I'm a 28 year old Licensed Clinical Social Worker. I don't make much money, so there will be no posts about my huge net worth or living off investment income at 35. I just decided I was tired of being broke and wanted to do something about it. My past (which I'll post more about another time) includes a teenage pregnancy, two college degrees (and the associated loans), a bankruptcy, a divorce... Basically I've made more mistakes than people twice my age, and I'm finally digging my way out.

I'll be pretty open here about my pathetic financial situation. I've never understood why people are so secretive about their money - I know I'm broke, and any readers will know it too. Welcome and bear with me as I figure this out.

A little background: I'm a 28 year old Licensed Clinical Social Worker. I don't make much money, so there will be no posts about my huge net worth or living off investment income at 35. I just decided I was tired of being broke and wanted to do something about it. My past (which I'll post more about another time) includes a teenage pregnancy, two college degrees (and the associated loans), a bankruptcy, a divorce... Basically I've made more mistakes than people twice my age, and I'm finally digging my way out.

I'll be pretty open here about my pathetic financial situation. I've never understood why people are so secretive about their money - I know I'm broke, and any readers will know it too. Welcome and bear with me as I figure this out.

Posted by

Andrea

at

7:36 PM

0

comments

Email This

BlogThis!

Share to Twitter

Share to Facebook

Share to Google Buzz

Labels:

intro

Subscribe to:

Posts (Atom)